The global VC industry remains resilient, and SA's VC industry has scope for growth

The global VC industry remains resilient, and SA's VC industry has scope for growth.

The private equity and venture capital industries in the world's most innovative nations play a critical role in bolstering their economic growth, competitiveness (as defined by the World Economic Forum Global Competitiveness Report) and job creation.

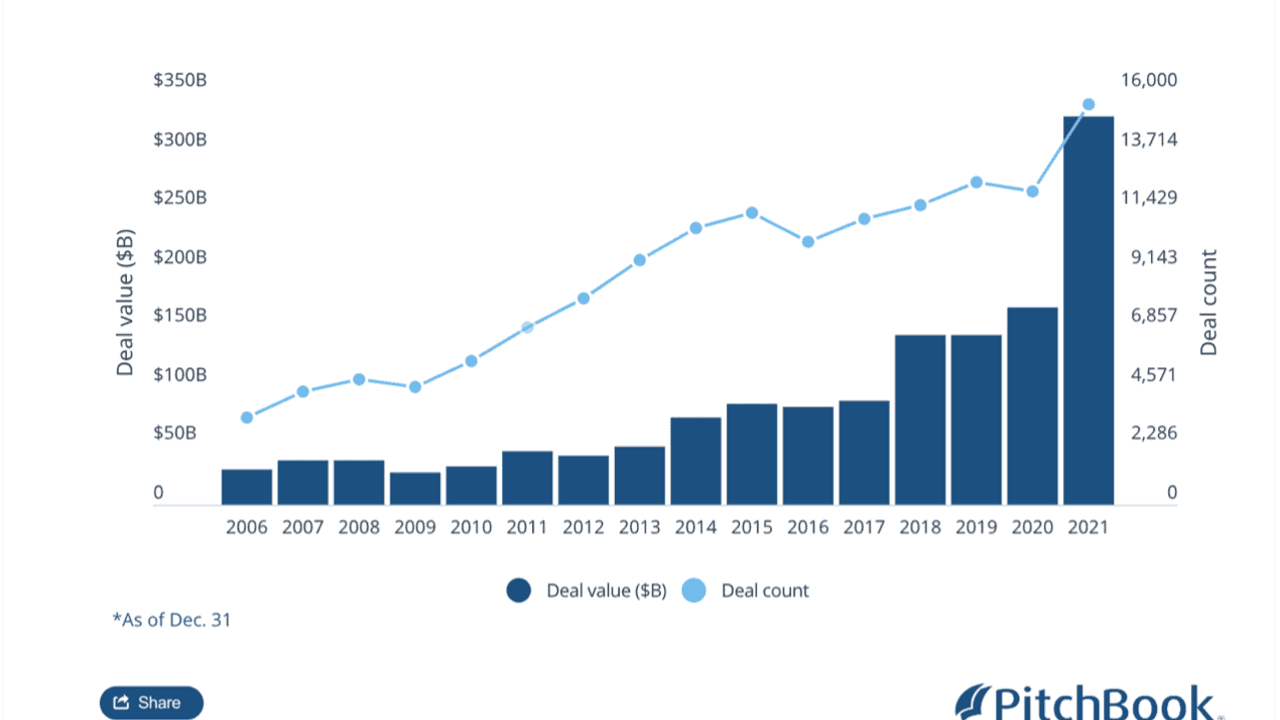

Twenty-twenty-one was a landmark fundraising year globally for private equity as an asset class in First World countries off the back of the economic rebound at the end of 2020, following the onset of the Covid-19 pandemic in early 2020.

According to EY's Private Equity Pulse Survey, there was a sharp uptick in investment activity in 2021 globally, with global private equity investments in the first half of 2021 almost tripling the value for the same period in 2020 and increasing 53.1% in the second half of 2020 to reach $584.3bn, an all-time half-year high beating the previous high of H1 2007.

After their most active year in history, with more than $1.2t in deals announced last year, private equity (PE) firms face a far more uncertain environment in 2022. According to the Pulse Survey, even though "deal activity currently remains robust, elevated levels of macro and geopolitical uncertainty have the potential to create headwinds for new transactions".

While venture capital (VC) investors - the segment of private equity that invests in start-ups and small businesses - face the same current economic volatility and uncertainty but has been the highest performing private capital asset class in America in recent years. Attractive returns have led non-traditional investors like mutual funds, private equity investors and sovereign wealth funds to increase their involvement in VC transactions, including mega-deals.

An interesting mega-deal that was concluded in 2022 came out of India. In January there were 13 deals of over $100 million each compared to three deals worth $680 million in January 2021. The largest deal recorded January this year involved Alpha Wave, Prosus Ventures, QIA, and others investing $700 million in an online food ordering and delivery platform, Swiggy.

US venture capital-backed companies raised $329.9bn in 2021, nearly double the previous $166.6bn raised in 2020. Deal values declined notably in the first quarter of 2022, owing to geopolitical uncertainty and the impact of the war in Ukraine.

// Source: Venture Monitor //

The venture capital industry is young but growing in South Africa

The private equity sector is a well-established industry in South Africa. On the other hand, the venture capital (VC) industry in South Africa is still relatively young and characterised by less institutional capital and smaller deal sizes. Most of their funding comes from corporations and high-net-worth individuals but not institutions.

At Empowerment Capital and Imvelo Ventures our goal is to drive a paradigm shift toward venture capital being seen as an incremental part of positively stimulating the South African economy. We are encouraged to see the amendments made to regulation 28 of the Pension Funds Act which will come into effect in 2023.

In a SAVCA statement regarding Regulation 28 the National Treasury said,

"To further facilitate the investment in infrastructure and economic development, the limit between hedge funds and private equity has been split. There will now be a separate and higher allocation to private equity assets, which is 15% increased from 10%.”

These types of amendments will release much needed investment into sectors like infrastructure which can help curb the load shedding crisis. Furthermore these fund allocations will create an enabling environment that will have a direct impact on ESG outcomes.

Venture capital investments on the rise

According to Thomson Reuters, the venture capital industry in South Africa has seen significant growth in recent years, measured by the amount of capital invested, the number of funds and deal flow.

Despite the severe economic downturn, South Africa's growing venture capital (VC) sector attracted the most significant investment amount on record in 2020.

During an excellent deal-making year in 2020/21, the South African venture capital firm, Empowerment Capital Investment Partners (Pty) Ltd, placed more than R200m into 18 South African start-ups. These deals include 3 SAFE contracts and were facilitated by its three investment funds – Andzani Ventures, Imvelo Ventures and Thuthuka Nathi Ventures. These investment funds get backed by South African corporates Sappi, Shoprite Checkers and Capitec Bank. The deals spanned an array of sectors, including agriculture and food and beverage, but with a bias towards various technology platforms and marketplaces.

The Southern African Venture Capital and Private Equity Association's (Savca) 2021 survey of the VC sector (covering the 2020 calendar year) found that 74 fund managers invested R1.39bn into 122 entities. This investment amount was the highest capital amount deployed into the sector (since it began surveying the VC industry in 2010), and it's a 13% increase over the amount of capital deployed by VC investors in 2019 when 69 fund managers invested R1.23bn into SA start-ups and small businesses.

According to Savca, South Africa's economic recovery would benefit from early-stage investing, but the sector is currently worth less than R7bn, compared to the nation's private equity sector of almost R200bn.

"We believe that the venture capital market in South Africa will in future be led by corporates offering market access in an all-inclusive manner, thereby achieving a combination of commercial returns and social impact," says Bongumusa Makhathini, CEO of Empowerment Capital.

A missed opportunity for institutional investors?

Although the venture capital sector in South Africa is maturing, experts believe not enough capital is being invested into the industry, and as a result, good opportunities get forfeited.

While there is an abundance of start-ups and impressive entrepreneurs to invest in potentially, venture capital fund managers struggle to raise enough funding to invest in all the excellent early-stage opportunities they come across.

"Successful businesses and their owners require different forms of support as they evolve from concept to start-up to that of a sustainable and profitable company. Large and established market players dominate the South African environment. However, we support SMMEs at various stages of their growth while ensuring that the capital invested supports sustainable development," says Bongumusa Makhathini, CEO of Empowerment Capital.

Institutional investors in South Africa could be missing opportunities to invest in early-stage ventures that could provide good returns, contribute towards job creation, and ultimately, economic growth. However, in South Africa, institutional investors are still prioritising investment in later-stage private equity funds and seen as lower risk and more scalable.

"There's still a lot of negative perceptions among institutional investors about the risks of VC," SAVCA CEO Tanya van Lill said when commenting on the 2021 SAVCA PE survey results. "Institutional investors need to realise that they can get good returns as well as make a phenomenal impact on the South African economy," she said.